How much tax do NHS Doctors pay?

13 Mar, 202311 Minutes

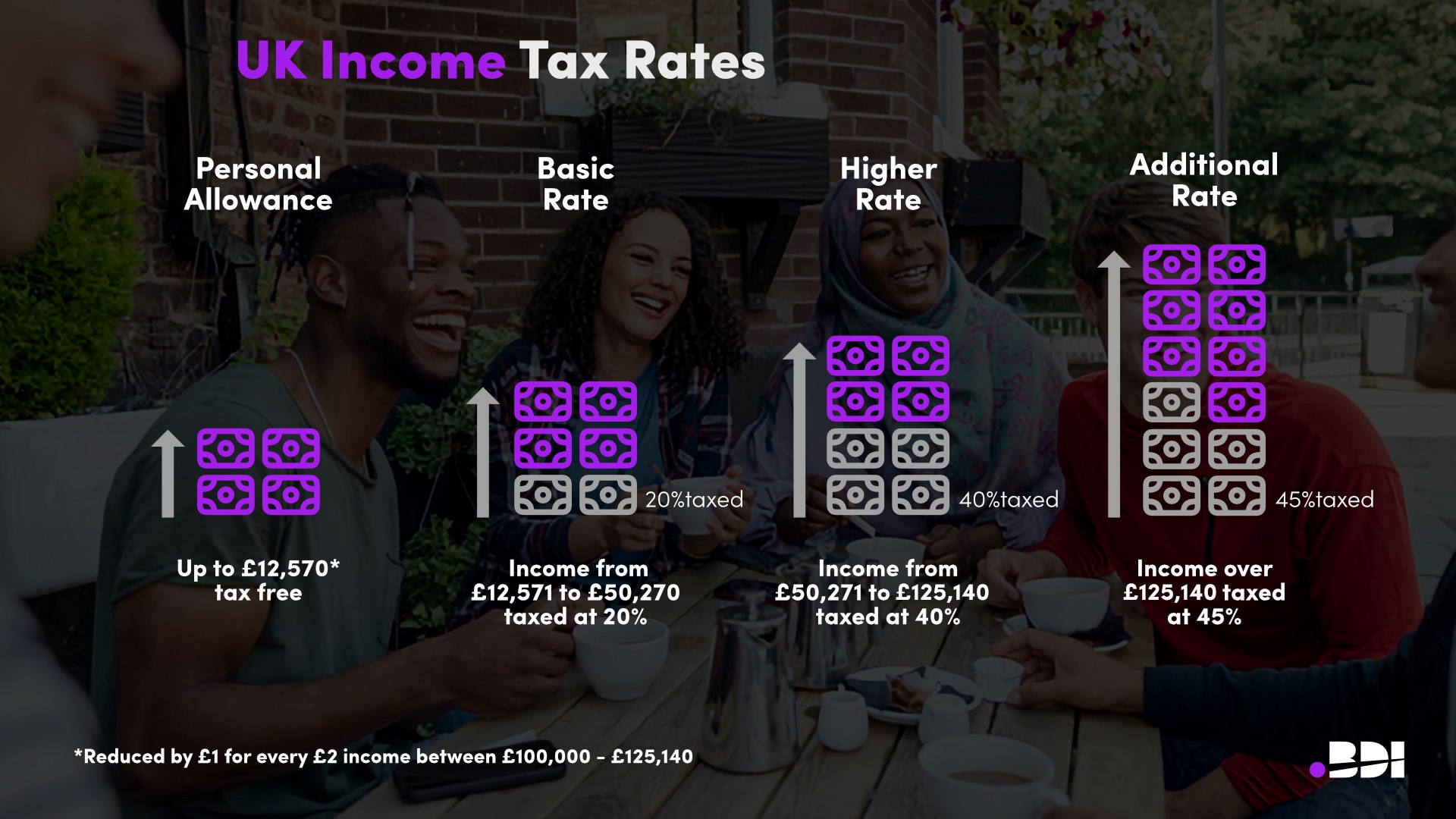

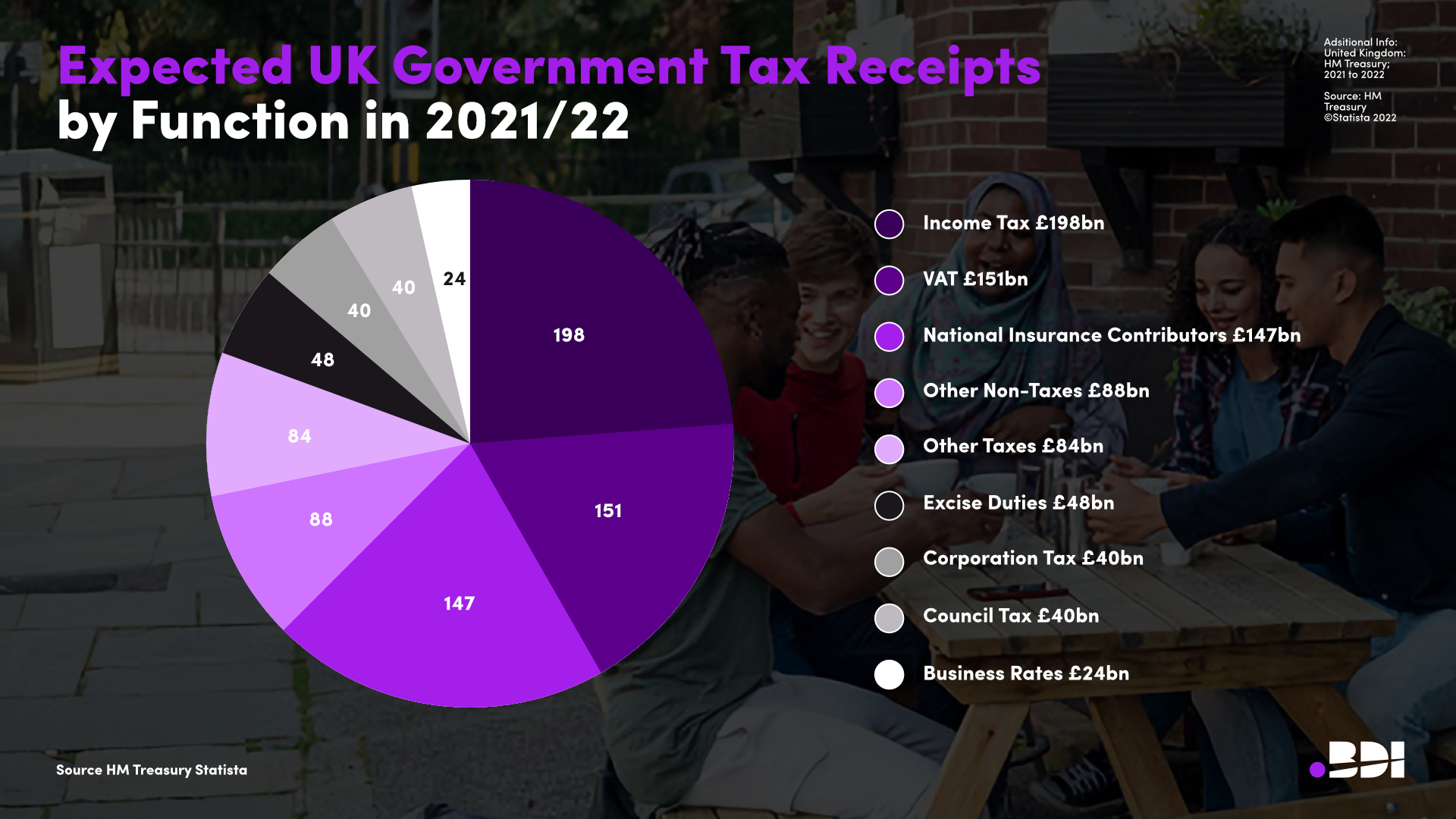

International medical graduates new to the UK might be overwhelmed at the prospect of understanding the UK’s tax system. However, it doesn’t have to be so daunting. With our guide below, you can learn about income tax, including how much you will pay as an NHS doctor. As you'll see in the following infographic HMRC collect tax revenues from a number of sources with income tax being the largest by a significant margin:

What is Income Tax?

Income tax is a deduction in your take-home pay from your job, which goes towards the government. Each government has its own set of rules regarding tax. Each country’s government also chooses where the tax goes. In the UK, income tax goes towards the following public services:

- NHS

- Welfare System

- Education

- Investment in Public Projects

- Emergency Services

Who Pays Income Tax in the UK?

Every person employed in the UK will have to pay income tax once they earn over a certain amount, including NHS staff. When working for an employer, you will receive a tax code from HMRC. This is assigned to you and will appear on all your pay slips.

Before paying tax, you are allowed a Personal Allowance, in which you don’t have to pay income tax.

What is Personal Allowance?

In the UK, every worker has a Personal Allowance, a set amount of money you can earn each year before paying tax. This changes every tax year, which runs from April 6th to April 5th the following year. For example, for 2022-2023, everyone in the UK was entitled to a Personal Allowance of £12,570. So, if you earn below £12,570 between April 6th 2022 and April 5th 2023, you will pay no income tax at all.

However, it’s important to note that for every £2 you earn over £100,000, £1 gets deducted from your Personal Allowance.

How Much Tax Do NHS Doctors Pay?

What about if you earn more than your Personal Allowance? Full-time NHS roles tend to pay significantly more than the Personal Allowance rate, which means you are likely to pay income tax when you come to the UK to work as an NHS doctor.

Every UK employee pays the same amount of income tax. The income tax bands decide how much tax rate you’ll pay on your taxable income.

Income Tax Band | Taxable Income | Tax Rate |

Personal Allowance | £0 - £12,570 | 0% |

Basic Rate | £12,571 - £50,270 | 20% |

Higher Rate | £50,271 - £125,140 | 40% |

Additional Rate | Over £125,140 | 45% |

So, for example, if you were to earn £32,398 in your FY1 year, you would receive a take-home pay of £25,824. If you were to earn £83,945 as a Specialist, you would have a take-home pay of £57,132.

To give a worked example of how the tax is calculated here are the numbers based on someone earning £70,000 per annum:

- £0 to £12,570 at 0% = £0

- £12,570 to £50,270 at 20% = £7,540

- £50,271 to £70,000 at 40% = £7,891

- Total tax on £70,000 = £15,431

What’s National Insurance?

National insurance is a form of social security you contribute when earning above £242 a week. This is for the welfare system in the UK. Paying towards National Insurance ensures that those needing to use the welfare system can afford the cost of living. The National Insurance rate is:

Income | National Insurance Rate |

£0 - £242 per week | 0% |

£242 - £967 per week | 12% |

Over £967 per week | 2% |

How Do You Calculate Take-Home Pay?

You don’t have to do it yourself on a calculator (although you can if you want to!). To see how much take-home pay you’ll receive during a tax year, you can use the UK online calculator. Doing this means you’ll know exactly how much you’ll earn to plan ahead.

To save you some time we’ve calculated the take home pay for various job titles using the most recent NHS pay circular. Keep in mind that these don’t include uplifts and other salary enhancements. Equally we’ve assumed a normal 1257L tax code and no pension contributions:

Job Title | Basic Salary | Take-Home Pay |

Foundation Year 1 | £32,398 | £25,824 |

Foundation Year 2 | £37,303 | £29,124 |

Speciality Registrar (CT1/2) | £43,923 | £33,577 |

Speciality Registrar (ST3+) | £55,329 | £40,744 |

SPR with 5 years experience (Old Pay Scale) | £48,637 | £36,748 |

Specialty Doctor | £52,530 | £39,141 |

Specialist | £83,945 | £57,132 |

Consultant | £99,532 | £66,965 |

How Do Doctors Pay Tax?

Fortunately, you won’t need to do your own taxes when you work for the NHS, as your tax will be calculated in the NHS monthly payroll, which is done through PAYE. It will calculate everything; from how much tax you must pay to your national insurance. When you receive your pay slip at the end of the month, you can see exactly how much you have earned and how much tax you’ve paid.

What is Tax Relief?

Tax relief reduces your tax burden for certain expenses and costs. HMRC has a definitive list of expenses that count as tax relief.

For example, you might pay for an expense related to your job (and only your job). You can then claim tax relief on that expense, reducing your overall gross income and lowering your tax. Some expenses UK doctors can claim tax relief on include:

- Professional membership subscriptions (such as GMC)

- Education

- Travelling to a temporary workplace

- Work gear/wear (such as scrubs and specialist equipment)

There are a handful of ways to claim tax relief. One is by completing a P87 form: tax relief for expenses of employment. Another is by completing a self-assessment tax return.

Will You Earn Enough to Cover the Cost of Living in the UK?

This can be a difficult question to answer, seeing as everyone has different expenses to pay for. For example, some people might have a large family and need to maintain a big house. Others might live in central London, where rent prices are much higher than elsewhere in the UK.

Generally, though, you can expect a doctor’s salary to cover your cost of living. Considering that the average is £31,876 and the top 10% earn £62,583, you can see that all doctors earn more than the average and most registrars and above are in the top 10%. Plus, most senior doctors make significantly more than that. So, when moving to the UK to work for the NHS as a doctor, you are likely to earn more than enough to feel comfortable.

In Summary

It’s crucial to understand the UK’s tax system before working there. After all, a portion of your earnings will go towards income tax, and you should know how much, as well as what it goes towards! Fortunately, the UK makes it easy for employees to pay their taxes, as it gets automatically deducted from their payslips. Here are some key points to remember:

- You only pay tax after earning over the Personal Allowance

- How much tax you pay depends on your tax bracket

- Tax is deducted by NHS payroll (including national insurance)

- You can work out your take-home pay with an online calculator

If you’re considering a career in the NHS then get in touch and we will be happy to talk through your options providing support, guidance and all the latest job vacancies.